Top Online Frauds And Scams You Need to Avoid Today (Expert’s Tips)

Computers have enhanced our speed and efficiency, but they've also made it easier for cybercriminals to steal from people and businesses. Read our experts tips to prevent online frauds.

Online fraud and identity theft scams appear to be omnipresent on the internet, but thankfully, there are ways to avoid falling victim to them, but it’s always a good practice to do a “fact check”. We, common people could be a pretty easy prey for malicious actors who want to steal our most valuable personal wealth or data. Millions of consumers trapped by cybercriminals and online hackers around the world. As per the FBI’s report in 2020, consumers in the USA lost more than $4.2 billion from online scams encountered through the web. Federal Trade Commission (FTC) report on ‘Online Frauds and Scams’ research concluded that “40 percent of adults age 20-29 who have been trapped in online fraud and ended up them losing money in different type of cyber scam in the USA”.

To avert such incident, we should to familiar about what are the most popular tricks malicious actors are using to get unauthorized access to our private information and financial data. We must remember their main goal is to steal our money and there is nothing they won’t do to accomplish their mission.

This helpful tutorial will teach you how to avoid falling victim to online frauds and other scam activities on the internet and keep yourself safe.

1. Most Popular Online Frauds:

Phishing email Scams

Phishing scams continue to rise and provide a significant challenge for users as well as enterprises that run the risk of having sensitive data obtained by malicious actors. More than one third of all security breaches, according to the most recent report from F-Secure, begin with phishing emails or malicious files sent to company employees. Because the effects of phishing attacks can be disheartening, it is necessary to remain safe and learn how to detect and prevent these attacks. Emails and messages sent through social media platforms like Facebook and Twitter are common communication channels used in phishing scams.

In many instances, cyber criminals send customers messages or emails in an attempt to deceive them into providing them with sensitive and valuable data (login credentials – from a bank account, social network, work account, or cloud storage), which can be useful for them. Furthermore, these emails will appear to be sent from an official source (such as a bank institution or any other financial authority, legitimate companies, or representatives for users on social networks). In this way, they will use social engineering techniques to trick you into clicking on a specific and malicious link and accessing a website that appears to be legitimate but is actually controlled by them. You will be taken to a bogus sign-in page that closely mimics the website you are trying to visit. In the event that you are not paying attention, it is possible that you will divulge your login credentials as well as other personal information. Phishing has been the primary vector of attack for many spam email campaigns that bad actors have used to install malware that steals bank information and other sensitive data. These campaigns have been observed by our team. Scammers instill a false sense of urgency in their victims in order to increase the proportion of their schemes that are successful.

They will tell you a frightening story about how your bank account is in danger and how you really need to access as soon as possible a site where you must insert your credentials in order to confirm your identity or your account. The story will make you feel as though you have no choice but to comply with their demands immediately. After you have provided your online banking credentials, cybercriminals will either use them to break into your actual bank account or sell them on the dark web to other parties who are interested in obtaining them. You should use extreme caution in response to the following example of a sophisticated phishing scam that has been circulating by email. Advice on how to stay safe when shopping online.

- Update your computers and mobile devices. The best way to protect yourself from viruses, malware, and other online threats is to use the latest security software, web browser, and operating system. Turn on automatic updates to get the latest fixes as soon as they come out.

- Set strong passwords. A strong password has at least eight characters, a mix of uppercase and lowercase letters, numbers, and special characters, and both uppercase and lowercase letters.

- Watch out for online frauds that use phishing. Phishing scams use fake emails and websites to trick people into giving out their login information or other private information. Do not click on links, open attachments, or look at pop-up windows from sources you do not know. Send phishing emails to the Federal Trade Commission (FTC) at spam@uce.gov and to the company, bank, or organization that the email pretends to be.

- Keep your private information to yourself. Hackers can use your social media profiles to figure out your passwords and answer your security questions in password reset tools. Lock your privacy settings and don’t post personal information like your birthday, address, mother’s maiden name, etc. Be wary of people you don’t know who want to connect with you.

- Secure your internet connection. Always use a password to protect your home Wi-Fi network. Be careful about what information you send over public Wi-Fi networks when you connect to them.

- Shop safely. Before you buy something online, make sure the site is safe. When you get to the screen for checking out, make sure the web address starts with “https.” Also, look to see if the page has a small locked padlock symbol.

- Read the site’s rules about privacy. Even though privacy policies are long and hard to understand, they tell you how the site protects the personal information it gathers. If a site’s privacy policy is hard to find or hard to understand, you might want to do business somewhere else.

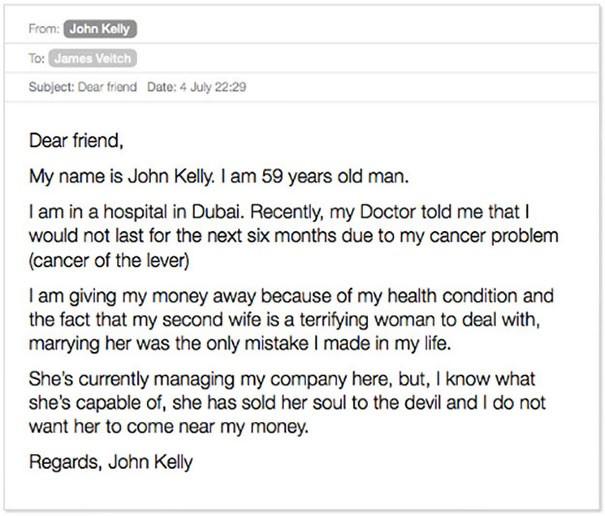

2. The scam from Nigeria

This is probably one of the oldest and most common Internet scams. It is usually used by a member of a wealthy Nigerian family to trick people. It is also called “Nigerian 419,” which comes from the part of Nigeria’s Criminal Code that forbids it. A typical Nigerian scam involves an emotional email, letter, text message, or social networking message from a scammer (usually a woman who pretends to be a member of the government, a businessman, or a member of a very wealthy family) asking for help getting a large amount of money out of a bank by paying small fees at first for paperwork and legal matters. They promise you a lot of money in exchange for your help. They will not give up and keep asking you to pay more and more money for things like transaction or transfer costs. You’ll even get papers that are meant to convince you that everything is real. In the end, you are broke and have none of the money that was promised. Here’s an example of a Nigerian scam:

3. Internet Scams with bank loans or credit cards

“Too good to be true” bank offers that promise large amounts of money and have already been approved by the bank are an easy way to scam people. If you are offered a pre-approved loan for such a large amount, you should ask yourself, “How can a bank offer me such a large amount of money without even looking at my finances?” “Even though it seems unlikely that people would fall for this scam, a lot of people still lost money by paying the “mandatory” processing fees that the scammers asked for. Here are 9 signs and tricks to look out for so you don’t fall for a business loan scam. A recent report from the Online Identity Theft Resources Center said that the number of credit and debit card breaches went up last year. This is related to credit card scams. To keep your information safer and stop thieves from getting your credit card information, think about:

- Keeping a close eye on your accounts and online transactions

- Using free services that help protect consumers

- Getting free credit monitoring by signing up

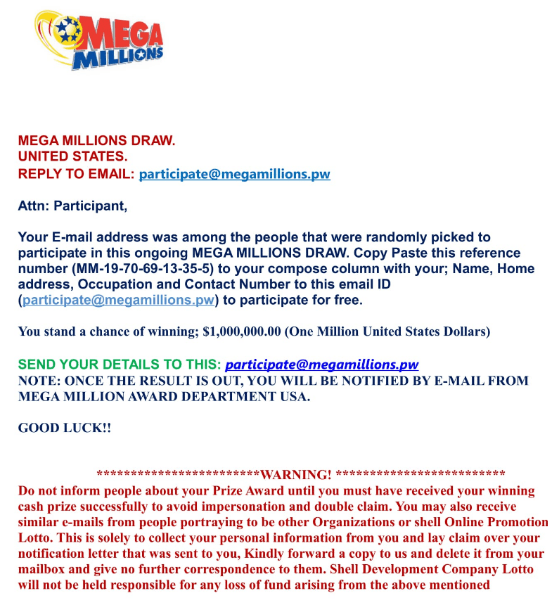

4. Lottery scam

This is another old type of online fraud that people still fall for. A lottery scam comes in the form of an email telling you that you won a lot of money and that you need to pay some small fees to get it. You’re lucky, right? Even if you don’t remember ever buying lottery tickets, that doesn’t make a difference. Since it deals with some of our wildest dreams, like being able to quit our jobs and live off the money for the rest of our lives without ever having to work again, it’s easy for our minds to come up with crazy ideas that are only possible in our dreams. But the dream ends when you realize you were just another person who fell for a scam. DO NOT fall for this online scam, and use this list to see if you are being taken advantage of.

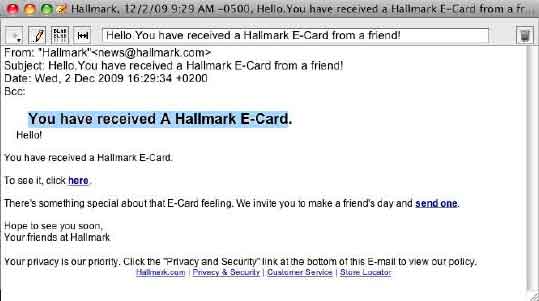

5. Scams with greeting cards

We all get holiday greeting cards in our email inboxes that seem to come from friends or people we care about, whether it’s Christmas or Easter. Greeting card scams are another old way that bad people use the Internet to spread malware and get the most valuable information from users. If you open this kind of email and click on the card, malicious software will usually be downloaded and installed on your operating system. Malware could be a bothersome program that opens ads and other random windows all over the screen. If this kind of dangerous malware gets on your computer, you will become one of the bots that are part of a larger network of computers that have been infected. If this happens, your computer will start sending private information and financial data to a fake server that is run by IT thieves. We recommend using a specialized security program to protect yourself from online threats like identity theft and data breaches. Read this article to learn more about what financial malware is and how it works. And here’s how you can tell if malware got into your computer.

6. Bitcoin scams

Cryptocurrencies, with Bitcoin being the most well-known, have taken the world by storm right now. They are fun to look at, tempting, and often very valuable. But only a small number of techies really know how these things work, and cybercriminals are more than happy to take advantage of your lack of knowledge to steal your money or, worse, all your personal information.

Most of these internet scams will ask you to invest in a company that is about to do an Initial Coin Offering (ICO) . You’ll get a piece of the company in exchange for your money, and the hackers will say that this will make you rich. Sometimes these companies do exist, but the coins they sell are either worthless or come with a lot of risks. Most of the time, though, these companies don’t exist, so your money will go to nothing. Also, if you do this, the person who called you will have your information and can use it to steal from you even more.

Thieves and scammers can get your cryptocurrency or trick you into giving it to them in a number of ways.

Crypto scams often try to get private information, like security codes, or get someone who doesn’t know what’s going on to send cryptocurrency to a digital wallet that has been hacked. Some types of scams are giveaways, romance scams, phishing, extortion emails, fake company alerts, blackmail, “rug pulls,” initial coin offerings (ICOs), non-fungible tokens (NFTs), and fake mining apps or networks.

Signs of a crypto scam are poorly written white papers, a lot of marketing, and promises that you’ll get rich quickly.

If you think you’ve been tricked by a crypto scam, you can contact a few government agencies and your crypto exchange.

If you really want to put money into Bitcoin technology, you should watch out for online scams. Digital wallets can be hacked, and con artists use this new technology to steal personal information. Even though Bitcoin transactions should be safe, these four scams show how they work and how you can lose money. Watch out for these common

- Fake Bitcoin exchanges

- Ponzi schemes

- Everyday scam attempts

- Cloud mining scams

- ICOs and NFTs

- Malware

7. Fake virus protection software

At least once, we all saw the message, “You have been infected! Get antivirus X right away to keep your computer safe. “Many of these pop-ups were made very well to look like real messages from Windows or other security products. If you’re lucky, the annoying pop-ups that appear on your screen while you’re browsing online will be nothing more than a harmless joke. In this case, you should scan your system with a good antivirus program to get rid of the annoying pop-ups. If you’re not careful, your system could get infected with malware like a Trojan or a keylogger if you’re not careful. This kind of message could also come from one of the most dangerous types of ransomware, like CryptoLocker, which can lock and encrypt your operating system and ask for money in exchange for the key to unlock it. To avoid this, we suggest adding a security product that protects against financial malware to your traditional antivirus program to improve your online security. Also, don’t click on those annoying pop-up windows that tell you that you have a virus. Remember to always install the latest updates for your software, and only install software from websites that can be trusted.

📚 Also Read: common Instagram scams and how to avoid them

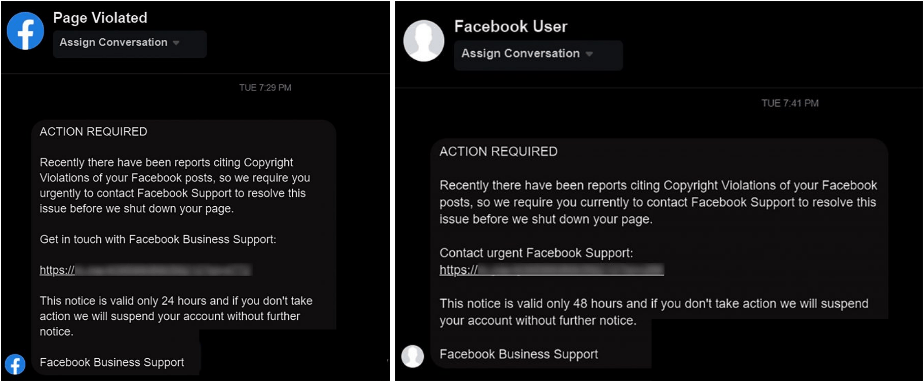

8. Facebook impersonation scam (hijacked profile scam)

Facebook. Everyone is talking about it right now, along with the scandal about the Cambridge Analytica company taking personal information from millions of Facebook users without their permission. It’s still the most popular social media site, and everyone uses it every day to keep in touch with friends and coworkers. It’s also a great place for online scammers to find people to take advantage of. Just imagine if someone broke into your account and got to know your close friends and family. No one would want that! Since your privacy and online safety depend on it, you should protect your personal online accounts with the same care you use to protect your bank account or email. If you want to stay safe on Facebook, these tips might help you avoid these online scams:

- Don’t agree to be friends with people you don’t know.

- Don’t tell anyone else what your password is.

- Use two-factor authentication when you log in.

- Try not to connect to free and public Wi-Fi networks.

- Update your browser and apps.

- Use proactive security software and an extra layer of security to protect your computer.

Read our full guide on Facebook security and privacy if you want to protect your privacy online.

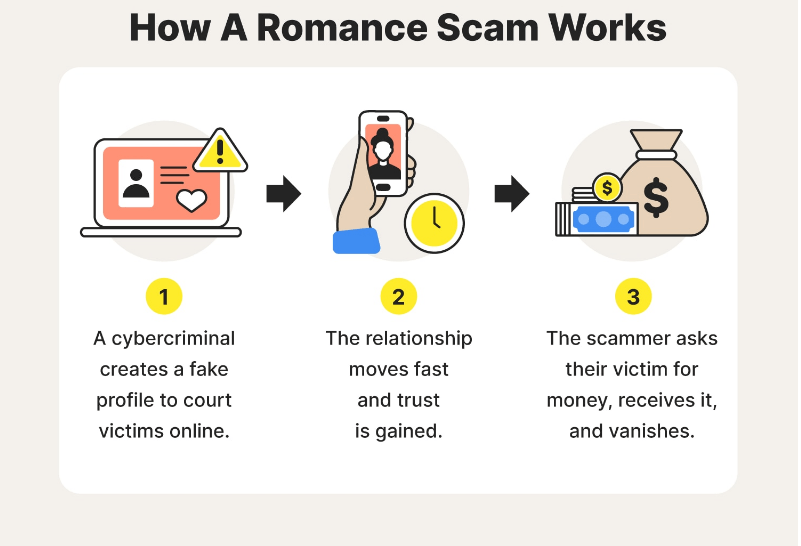

9. Romance scams on online dating sites

Since the Internet is a big part of our social lives and we use apps like Facebook and Instagram every day, it makes sense that we would also use apps to look for love. Online dating apps are very popular these days, and they are a great way to meet potential life partners. One of my friends met her future husband on a dating site. But not all situations have a “happy ending” like this one, and you need to be very careful because you never know who you might meet. A romance scam usually happens on social dating sites like Facebook or by sending a potential victim a simple email. Thousands of people from all over the world fall for these scams. Most male con artists live in West Africa, while most con artists who are women come from the eastern parts of Europe. Cybercriminals have been using dating site scams to pull off this kind of scam for years. By seeing how the potential victims responded, they were able to improve their plan. Research that was published in the British Journal of Criminology last month says that the techniques (and psychological methods) used by scammers in online romance scams are similar to those used in domestic violence cases. You need to learn how to protect yourself so you don’t fall for these Internet scams. Knowing that hundreds of women and men from all over the world fall for these internet scams, we recommend using these safety tips for defensive online dating. They include warning signs that could help you avoid being an easy target. I also think you should read the following true stories and learn from them so you don’t fall for these online frauds:

See, how a romance scam took a place and you fall prey.

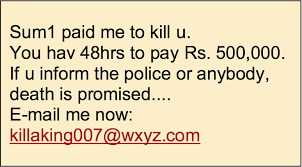

10. Hitman scam

The “hitman” extortion attempt is one of the most common types of online scams you can find on the Internet. Cybercriminals will send you an email that threatens to make you pay them money. This type of online scam can take many different forms, such as threatening to kidnap a family member if a ransom isn’t paid within a certain amount of time. The message is full of details about the victim’s life that were taken from an online account, a personal blog, or a social network account. This gives the impression that the danger is real. Because of this, it’s not safe to share private or sensitive information about yourself on social media. It might seem like a safe and private place where only your friends are around, but in reality, you never know for sure who’s watching you. Also, it’s better to be a little bit paranoid and protect all your digital assets as if everyone is watching. Here’s an example of a Hitman scam:

11. Scams to make money fast (Financial scams)

Cybercriminals will make you think that it is easy and quick to make money on the internet. They will promise you jobs that don’t exist, as well as plans and ways to get rich quickly. It’s a simple method that works well because it meets a basic need for money, which is especially important when someone is in a tough financial situation. This way of stealing money is similar to the romance scam we talked about above, in which cybercriminals play on the victims’ emotions. Online criminals can use fake job postings to trick people into applying for jobs that don’t exist. Using different types of jobs, like work-at-home scams, the victim is tricked into giving away personal and financial information by promising a well-paid job that will bring in a lot of money in a short amount of time. Read and use these ten tips to avoid some of the most common types of financial scams.

12. Travel scams

Most of the time, these travel scams happen during the hot summer months or right before Christmas or New Year’s Day, when people have short breaks from school. Here’s how it works: you get an email with a great deal for a unique and hard-to-refuse destination (usually somewhere exotic) that ends soon and you can’t miss. If it sounds too good to be true, it might be a travel scam, so don’t fall for it! The problem is that some of these offers hide necessary costs until you pay for the initial offer. Others will just take your money and not do anything with it. In these cases, we recommend that you carefully look over the travel offer and look for hidden costs, such as airport taxes, tickets you need to buy to get into a local attraction, whether meals are included or not, other local transportation fees between your airport and the hotel or between the hotel and the main attractions listed in the initial offer, etc. As a general rule, we recommend that you use a well-known, trustworthy travel agency.

You can also see if the results are the same if you buy plane tickets and a place to stay separately and pay for them separately. If you like to travel, all you have to do is look for free airline tickets to fall for airline scams. Some of the most common travel scams involve airlines, so we suggest you use these helpful tips.

13. Fake news scam

We are all at risk when fake news spreads on the Internet because it changes how we sort through all the information we find and read on social media. It’s a big problem that should worry us all, especially because there are so many misleading resources and articles online that make it hard for people to tell what’s real and what’s not. To avoid fake news, we suggest that you only get information from trustworthy sources like friends or people you know. You can also get regular feeds from trusted sources like bloggers and industry experts.

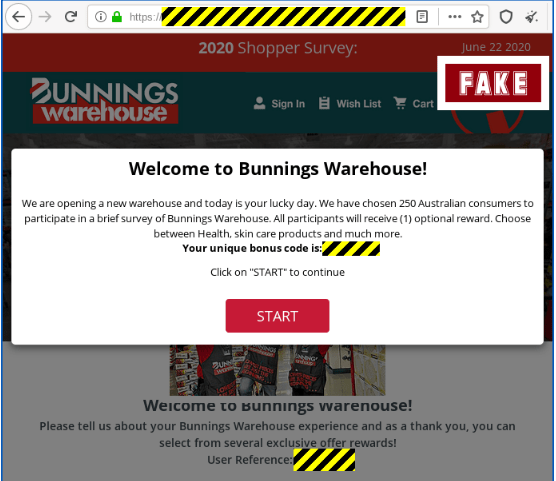

This kind of scam could come in the form of a website you know and trust, but which turns out to be a fake one made by people who want to steal your money. It could be a spoofing attack, which is related to fake news and involves making fake websites that link to a page where you can buy a product with your credit card. To avoid falling for online frauds, you can use tools like Google’s Fact Check or Facebook’s tool that analyzes a site’s reputation and data to figure out if it’s real or not. Experts in cybersecurity say that these Internet scams pose a risk to both companies and their employees because they could expose and infect their computers with malware.

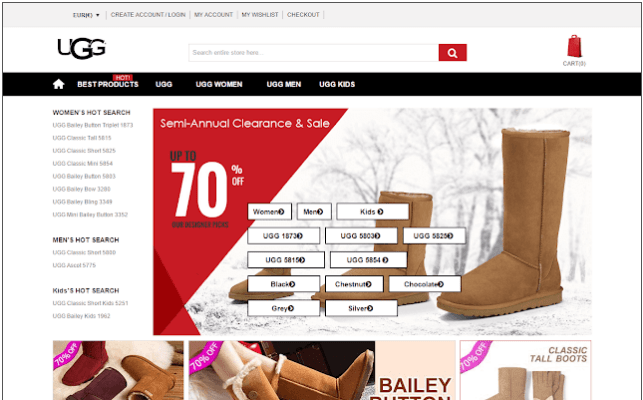

14. Fake shopping sites

We all like to shop, and the Internet makes it easier and more convenient to do so. But if you want to stay safe online, you should be careful about the sites you visit. There are thousands of websites out there that give you false information or might send you to links that are harmful and give hackers access to your most important information. If you see a great online deal that seems “too good to be true,” you might be tempted to say “yes” right away. However, you need to learn how to spot a fake shopping site so you don’t get scammed. We recommend that you read these tips for safe online shopping if you want to avoid data breaches, phishing attacks, and other online threats.

15. Phishing scam with loyalty points

Many websites have a loyalty program that gives customers points or coupons when they buy things from them. Cybercriminals can use this to steal your personal information and start another online scam. You’re wrong if you think no one would want to get to them. The most common type of attack is phishing, which looks like an email from your loyalty program but isn’t. Malicious hackers are everywhere, and all it takes is one click for hackers to gain access to your data and install malware on your computer. Since it may be hard to spot these phishing scams, this example of a current phishing campaign that targets people with Payback couponing cards and some tips on how to avoid being phished may help.

16. Fake job offers

Even when you are looking for a job, there are scammers everywhere who pose as recruiters or employers. They trick people by putting up fake ads for “attractive” jobs. Someone calls you or sends you a direct message on LinkedIn, saying they are a recruiter from a well-known company who saw your CV and is interested in hiring you. Even if you haven’t applied, the offer may seem very good, but don’t fall for this trap. To avoid getting ripped off by fake job offers, it’s very important to:

Do a lot of research on the company and find out as much as you can about it;

Check out the person who got in touch with you on social media;

Ask for a lot of information and references, and then check them;

Ask your friends or other people you trust if they know the potential employer or have talked to them.

Check out this article to learn how to avoid these types of online job scams.

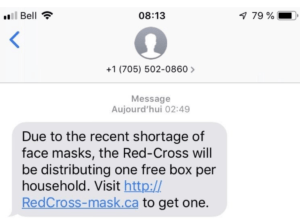

17. SMS Scams (Smshing)

Smartphones. In the Internet age, you can’t live without them. They are now needed to communicate, shop online, bank online, or do anything else online. Because we store so much information on our personal devices, cybercriminals are always ready to steal our online identities or empty our bank accounts. Smishing is similar to phishing, but instead of sending emails, hackers send text messages to people they think might be easy targets. How does this happen? You get an urgent text message on your phone with a link that says it’s from your bank and you need to go to it to update your bank information or other online banking information. Be careful with these SMS messages you get, and don’t click on strange links that could lead you to sites that try to steal your valuable information. These tips will make it easy for you to spot these kinds of online scams.

18. Scam on Overpayment Online

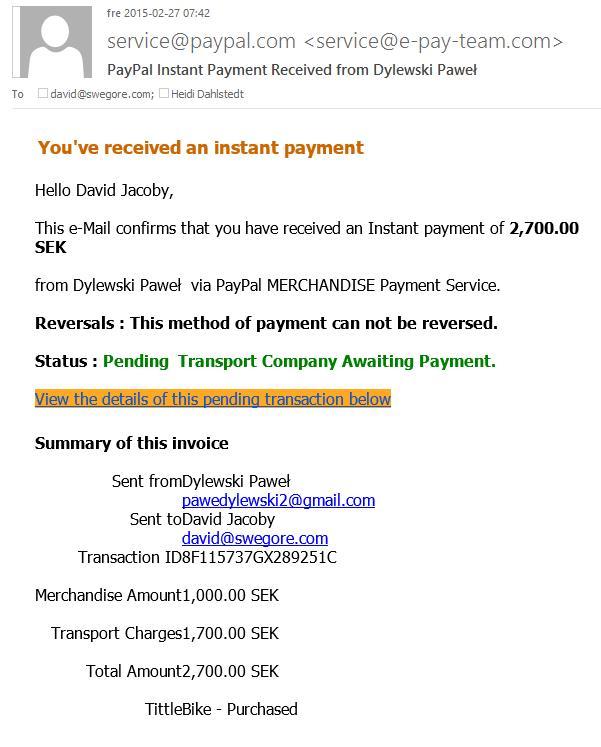

If you want to sell different things on specialized websites, you should be very careful about overpayment scams. In most online frauds like this one, the scammer asks the potential victim to “refund” him or her extra money because the person sent too much money. Most of the time, the offer will be more than the agreed price. The extra money (overpay) is to pay for shipping costs or customs fees. One of these stories could happen right now to any of you. One of my team members had this happen to them. After we laughed a little and saw how it worked, we realized it was a common online scam, so we had to tell you about it. Also, we gave you some security tips and things you can do to avoid falling for an online overpayment scam. A coworker put a couch up for sale on a Danish website called dba.dk, which is like an online flea market. After a few days, he got a message through his PayPal account from someone who said they were interested in the item and willing to pay more than what was being asked. Here’s an example of a phishing email, in which the scammer asks to make some funds so they can send the money.

After that, he got another email telling him that he needs to send the extra money, including the shipping and transportation costs, to a certain shipping agent via MoneyGram transfer. Here’s what the phishing email looks like, and why you shouldn’t fall for it:

Follow these safety tips to avoid online scams involving overpayment:

- If you get an email from someone you don’t know or that seems strange, you should report it as soon as possible.

- If you get an email like the one our colleague got, don’t send extra money to someone you don’t know, especially if that person wants to overpay. That’s not what a real buyer would do.

- Also, don’t send money to a fake shipping company or a private shipping agent. This is a scam, so be very careful.

- Do not give out personal information to people who don’t seem serious about buying your product.

- Don’t send the item to the buyer until you’ve been paid and the money is in your bank account.

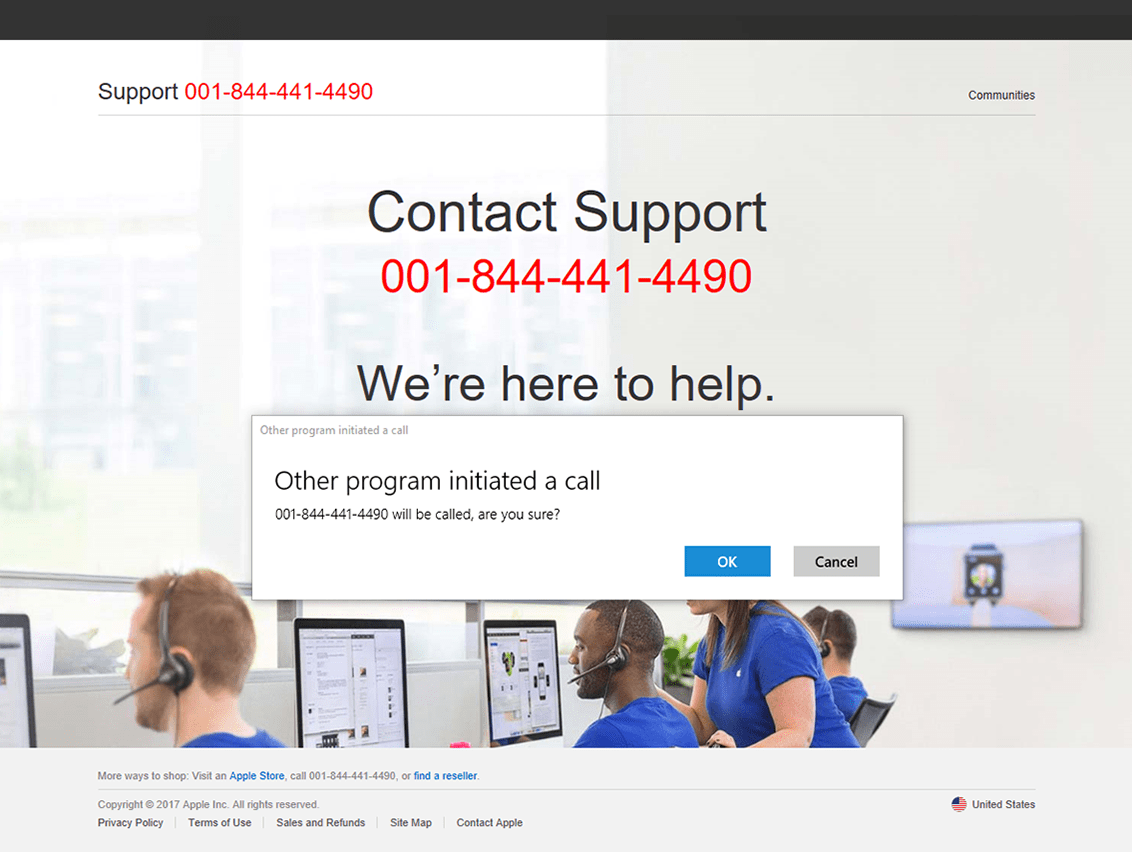

19. Tech Support Online Scams

The most common way for fraudsters to reach users is to send them to a fake website that they made. The user is shown an alert message on the fake website, which is a social engineering trick to get the user to call a phone number. In addition to the fake pop-up message, some scam websites use alarms or voices to stress out the user and get them to call the number.

Some tech support scams also use email or even SMS messages, but these are much less likely to work than alerts that appear right on the user’s screen.

McAfee recently reported on another method, which involves making Twitter or other social media accounts that look like official technical support websites and using hashtags to make them more visible and attract users who don’t know what’s going on to their fake websites, which can look very official and convincing.

Some fake websites, for example, use the McAfee logo or the logo of another company to get people to click on a login or activation link. Once the user clicks on it, it asks for their username, password, and phone number. After this step, they show an error message that tells the user to call tech support or click a link to a chat box to start a conversation with the scammer.

Scammers often use very technical words to make it seem like they are professionals and get their victims to believe everything they say.

Also, once they have control of the computer, they show the user very graphic interactions that make the user think they are experts and can do amazing things on the computer.

The scammers might use a command line that most users don’t understand, like listing directories or typing simple commands.

McAfee says that some scammers also put their phone number in the Windows taskbar, which is smart because the user might call them later for a real or fake computer problem.

- Do not believe people who call you on the phone claiming to be “tech experts,” especially if they ask for your personal or financial information.

- Don’t give them any sensitive information or buy any software services they might suggest as a way to fix your tech problem.

- Do not let strangers use your computer from afar and possibly install harmful software;

- Make sure you only download apps, software, and services from the official sites of their creators;

- Don’t think it’s normal if a stranger calls you out of the blue and says they can fix your technical problems. Make sure you ask for proof of their identity and do a quick search on the company they are calling from;

- Install an antivirus program on your computer at all times. For even more protection, think about adding multiple layers of security with a proactive security solution.

- Think about safety first and be suspicious of everything you see. You should also think about spending money on education and learning as much as you can about cybersecurity. Here are some ways to cut down on unwanted phone calls.

20. Online survey scam

Everyone has an opinion, and there are lots of people, from corporate marketers to political pollsters to Facebook friends, who want to hear them. But be careful when you get a survey request. It could be a way for thieves to get money from your opinions.

Survey scams can look different. You get a phone call, email, or text message, or you see an online ad or social media post asking you to fill out a survey or poll. Con artists might pretend to be well-known stores or service providers (like your bank or cell phone company) to find out how happy their customers are. They might try to get your attention by asking you what you think about something a celebrity did or a candidate running for office.

There are also telemarketers who pretend to be survey takers so they can call people on the National Do Not Call Registry who have asked the government not to call them.

There are many good companies and organizations that do surveys for research or to improve their products and services. But people who use fake surveys don’t really care what you think. Their goal is to get you to call a number or click on a link to a fake survey website. They often use “free” cash, gift cards, tech gadgets, or travel as bait to get you to do this.

Along with questions about the supposed topic, fake surveys ask for personal or financial information, like a credit card number to pay for shipping costs for a prize, which a real survey will not do. They might offer you a “free trial” that is really a pricey subscription to a dietary supplement or other product.

If you click on the link, it could also start up malware that can steal private information from your device. In either case, the scammers get information that they can use to steal people’s identities or sell to other bad people.

Some big stores, like Amazon and Walmart, do reward customers with gift cards if they fill out online surveys about their shopping experiences. However, these companies say they will never ask participants to give sensitive information.

As with many other online frauds that have been around for a long time, survey scams now have a pandemic twist. Thieves send emails and texts pretending to be from COVID-19 vaccine makers Pfizer, Moderna, and Astra Zeneca asking for feedback on the shots in exchange for a free prize like a new iPad. Like older versions, it’s a trick to get credit card or bank account information. Read this to know about corona virus scam showing false information to infect your system.

Please be alerted if:

- In a survey, you might be asked for personal information like your Social Security number, credit card or bank information, or a password for an account.

- A survey invitation has bad grammar, misspelled words, or words that don’t make sense. When real companies do market research or ask customers for feedback, they carefully edit the messages they send.

- A survey website doesn’t show you its privacy policy or tell you how it will use the information you give it.

21. Fine print scam

Do you read the fine print when you sign up for something online, like premium access to a game like Angry Birds or a great weight loss product? Not many do.

It is thought that only about 20% of people who sign a contract read the small print. For the other 80%, who are called “skim readers,” it’s because there’s too much to read and they trust what the company says. However, when you sign up or click “agree,” you may be agreeing to more than you think, which could mean extra fees.

Try it out for free

Many online scams with small print start with a free trial offer. You see an offer on the Internet for a free one-month trial of a unique product, like a program to help you lose weight, new shoes or clothes, or a better Internet provider.

So what? You’ll try it out. It’s no cost. Costs for shipping and handling are low.

What you don’t know that can cost you is that the fine print has terms that require you to pay monthly fees every month after the free trial period ends or until you cancel.

Most people don’t read all the small print, and companies know this. So do scammers posing as companies. Some tricks are used to make you feel at ease with the free trial. For example, the numbers are written out without dollar signs. In the fine print, different colors show when you can end your free trial. This is called “washing the text” or “fake pictures with fake testimonials.”

Types of fine print scams

Telecoms and Internet access are at the top of the list, followed by home entertainment, home delivery, and home improvement.

- Contracts with restrictions that come as a surprise and extended warranties that don’t cover everything.

- Contracts have extra, hard-to-understand charges in the fine print, like redundant fees.

- Clauses that make it hard to switch service providers, like the high cancellation fees that most gym memberships have.

Companies you have done business with for a long time and trust will let you cancel. If you can’t get out of a contract, you should cancel your card and try as hard as you can to get your money back.

22. Mobile Deposit scams

Mobile deposit scams involve criminals depositing fraudulent checks into victims’ bank accounts to steal money. After making deposits, victims are urged to withdraw and refund the money, usually through a third-party account. Cybercriminals often make up elaborate scenarios to make mobile deposit schemes look more real.

72% of mobile banking scams include remote deposits and fraudulent checks in 2019. More than 27,000 fraudulent check frauds were reported in 2019, with losses of $28 million. Mobile deposit scams target the elderly and young individuals, especially twenties. 51% of these scams are employment or career chances, 18% are internet selling scams, and 4% are awards or rewards.

Types of remote deposit scams

There is a wide variety of fraudulent remote deposit schemes, but two of the most common involve false payday lenders and job postings that are intended to trick victims into sending money to them.

Scam dating/sweetheart apps

Last year, sweetheart scam victims lost $304 million, up 50% from 2019.

Cybercriminals build false accounts on Hinge, Tinder, or Craigslist. They create trust and rapport over weeks or months. After establishing a “connection,” they ask for money for a medical emergency, burial, or hospital bill.

These fraudsters solicit for wire payments or new bank accounts. The stolen money is deposited before the wire transfer. Scammers typically claim to be overseas and beg victims to switch to email or text messaging.

Sweetheart scams may be devastating. They can empty a victim’s savings or hard-earned cash and violate trust by simulating a romantic relationship.

Fake jobs

Work-from-home scams are rising as more jobs become remote. These frauds target persons in their 20s and 30s, especially those seeking remote work. These mobile deposit frauds tout nonexistent employment like mystery shoppers or obscure marketing opportunities. After applying, applicants must provide their banking information to receive an online deposit for job-related charges. Once the fraudster gets enough information, they drain the victim’s bank account.

How to avoid mobile deposit scams?

There are several strategies to protect yourself from financial scams. Here are some tips for protecting your financial information:

- Be skeptical of financial or banking-related communications that sound too good to be true, especially if you’re solicited for personal information.

- Perpetrator requests wire money or gift cards.

- Ask victim to keep relationship or online interactions private

- Fraudsters send unexpected money requests.

- Online banking logins are requested from victims.

- Source-check. Contact the source if an email or text message requests personal information.

- Use a secure checking or savings account from a reliable bank like Texas Tech Credit Union and monitor account activity. Don’t check bank statements monthly. Check them weekly for questionable activities.

- Don’t share your info. If your bank calls to verify your details, indicate you’ll call back using your debit card’s number.

- Protect social media profiles. Cybercriminals utilize social media to learn where victims bank or shop. Don’t overshare.

Staying watchful and learning to detect mobile deposit frauds will help you avoid financial scams and protect your bank accounts. Learn how Texas Tech Credit Union’s checking and savings accounts protect your finances and identity.

Related Articles:

- Strong password ideas to stay safe online

- I recorded you email scam asking for bitcoin

- Read more on Corona virus email scam alert

- How to stop robocall scams in the USA

- Phishing as a service (PaaS): How cyber crimincals scale their attacks

Where can online scams and frauds be reported?

If you fall for a scam on the internet and looking for online fraud reporting, you can tell these government agencies about it on their scam reporting website.

- Econsumer.gov – Report international frauds. A group of more than 40 agencies from around the world that work to protect consumers. Takes complaints about shopping online and doing business with foreign companies online.

- Internet Crime Complaint Center (IC3) – Inform about international scams. Takes criminal complaints about the internet and sends them to federal, state, local, and international law enforcement agencies.

- Federal Trade Commission (FTC) – US only. Consumer complaints and online scams are shared with all levels of law enforcement.

- Europol – For Europe. Several European countries listed with direct links and emails where you can report online scams.

Our expert’s tips to prevent any online frauds or scams

1. Be Picky About the Applications You Put on Your Device.

Be wary of the software you download or install on your smartphone, especially if it involves financial transactions, even if it’s not money-related. The applications must be legitimate and produced by reputable firms or organizations in order to be considered. One of the prominent cyber security officers stated that individuals should only download and utilize banking or shopping apps that are available in the app store of the individual’s mobile platform. Expert’s comments were made in response to a question from an audience member (Google Play Store, Windows App Store, iPhone App Store, etc). Make sure that important accounts are not used to access temporary apps, and that individuals do not post any information about themselves through these platforms.

2. Avoid Online Transactions on Public Networks

When doing any kind of financial transaction, you should never utilize a public network. Additionally, you should never use public hotspots or Wi-Fi in locations like hotels, airports, or any other similar establishments. This is due to the fact that public networks are open networks; as a result, they are susceptible to the risks of data theft, as the encryption on these networks may be readily cracked by hackers, allowing them access to the essential information of any account. Therefore, it is strongly recommended that you do not conduct any financial transactions until after you have successfully linked your device to a personal internet connection that is protected by a password.

3. Only use connections that are encrypted.

The need to access free WiFi in a public place like a restaurant, hotel lobby, or airport can potentially lead to fraudulent financial activity. When conducting financial business, you should avoid using public Wi-Fi hotspots. As a result of the ease with which their encryption can be broken, public networks provide a greater danger of having their users’ data stolen. This makes it possible for hackers to obtain sensitive information about their users’ accounts.

4. Take extra precautions when using your card.

When using a credit card, the transaction should always take place in plain view. Check to see that the point-of-sale machine is authentic in every way. There are numerous of accounts of card information being stolen by skimmers who were able to do so since the card was not visible to them while the transaction was being processed. Don’t give someone the opportunity to take advantage of your carelessness and steal the money you’ve worked so hard to obtain.

5. Don’t compromise on security software for phones/computers

Everyone wants their financial transactions to be safe, but I wonder how many of you actually pay attention to the security software, web browser, and operating system on your mobile device and desktop computer. Make sure the security on your personal computer, laptop, and mobile device is up to date to avoid any mishaps online. In addition to this, you should always make sure that your passwords contain a mixture of uppercase and lowercase letters, numbers, and special characters. It is imperative that you remember to alter the passwords on a frequent basis.

6. Avoid sharing any private information to third parties at any costs.

Never give up any of your personal information, whether it be online or off, until you are one hundred percent certain that the person you are dealing with is genuine. It is conceivable for a con artist to conceal themselves behind a stranger or any third party while impersonating a high-ranking official at a financial institution or bank. Always be sure the individual who asks for your financial information can be identified before providing it to them. On phone calls, the authorities at the bank will never ask for sensitive information such as an OTP or CVV. Also, the disclosure of essential financial information such as one’s bank, branch, and account number

7. Only visit websites that have been authorized.

Be wary of websites that appear to be legitimate but are actually fraudulent, even if they use the same URL or hold the same domain name. Keep an eye out for “https://” before the “www” in the address bar of your browser, as well as the lock icon.

Conclusion:

Because some scams are so well-planned and convincing, and because the people behind them are so hard to catch, we should always be on guard. Stay up to date on the latest tricks scammers are using.

ad

Comments are closed.