What is a Data Broker?

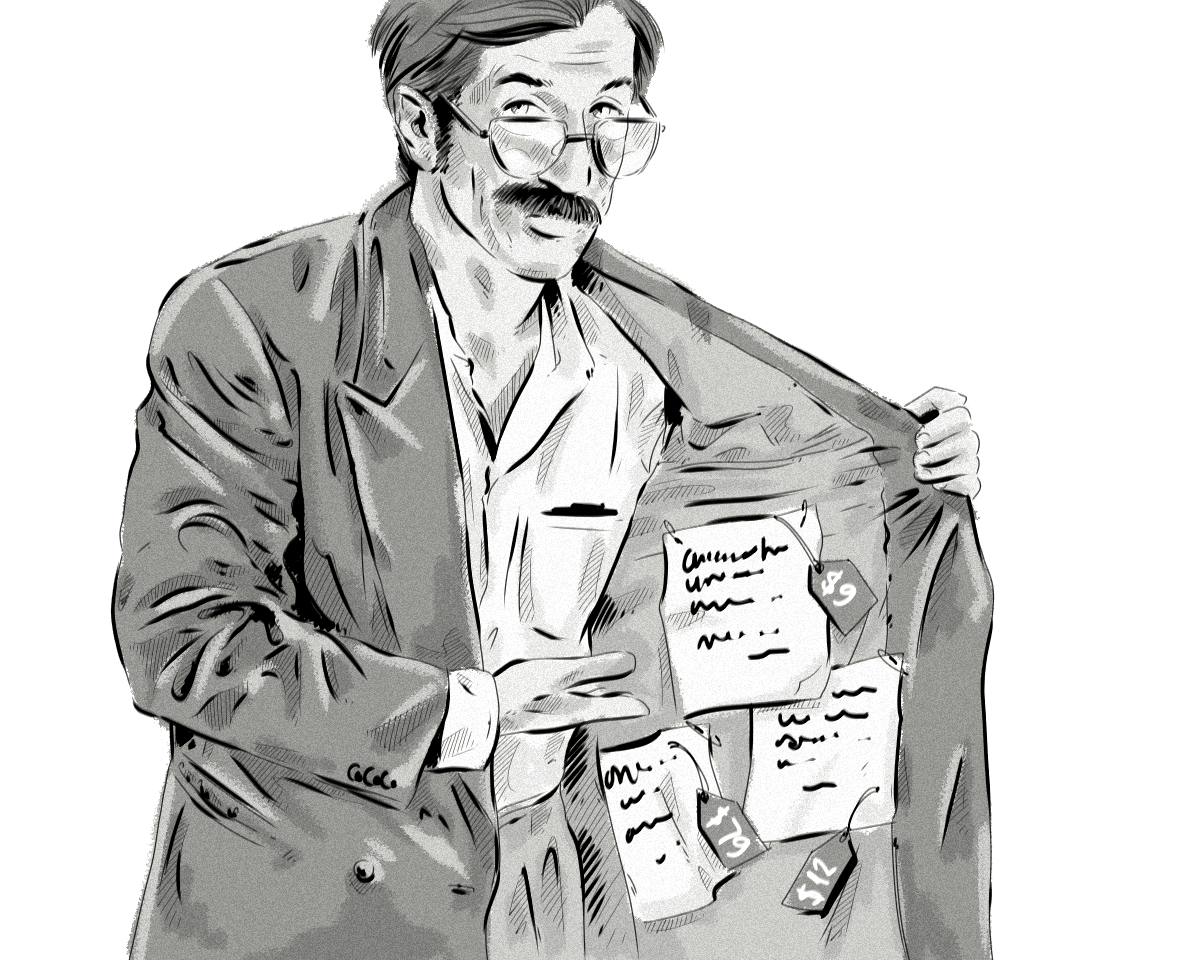

A data broker, also known as an information product company, is a business that generates revenue by gathering personal information, analyzing it, and licensing it to other companies for purposes like marketing.

Data providers collect information from various sources to build a profile of you, which includes your interests, hobbies, demographics, and even the products you use.

Typically, data broker companies interact solely with customers to gather information. Leading data brokerage companies include Epsilon, Acxiom, and Experian, but numerous data brokers worldwide profit significantly from collecting and distributing consumers’ personal data.

This article provides comprehensive information about data brokers, detailing their functions, methods of obtaining your information, and steps you can take to restrict their access to your data.

ad

Where do data brokers get your information?

Information brokers can obtain your information through several online and offline methods.

Publicly available sources: Some personal records are easily accessible to the public. Data brokers can collect public records such as your voter registration, birth certificate, criminal record, and bankruptcy records.

Search history: Data brokers can track and analyze your browsing history to determine your interests and demographics. You leave a trail whenever you perform activities online, such as signing into a social media app, visiting a website, or conducting a Google search. Web scraping tools (software that extracts information from the web) make it easy for data brokers to see your online activities.

Online agreements: When signing up for a new service online, you usually have to agree to terms and conditions. Many of these agreements include fine print that grants the company the right to collect and distribute your personal information.

Purchase history: Data brokers are interested in knowing what products or services you’ve purchased, how you paid for them (e.g., credit card, debit card, coupon, or loyalty card), and when you made these purchases. This information is highly valuable to marketing companies.

Are data brokers illegal?

Generally, it’s legal for data brokers to collect your information from public sources. However, different regions have varying consumer protections and regulations governing data broker operations.

Many countries have laws to prevent the sharing of consumer information without consent. For instance, the European Union’s General Data Protection Regulation (GDPR) mandates that data brokers obtain consumer consent before sharing their information. The GDPR also allows consumers to request the deletion of any stored personal data.

In contrast, the United States lacks federal privacy laws regulating data brokers. Instead, individual states create their own regulations, with some prioritizing consumer privacy more than others. For example, California’s Consumer Privacy Act grants consumers the right to see the data a broker has on them and to request its deletion.

Typically, companies obtain consent to share your information through the fine print in their agreements. Consequently, you might not realize how much personal information you have permitted organizations to share.

Who are the largest data brokers?

Data brokering is a massive industry, with global data brokers generating hundreds of billions of dollars annually. Here are some of the largest data brokerage companies that may collect your information:

Epsilon Data Management, LLC: Businesses worldwide rely on Epsilon for consumer data. The company has an extensive database with details about millions of households. You can request that Epsilon not collect your data through their website.

Oracle America, Inc. (Oracle Cloud Data): Oracle is a technology conglomerate that designs and produces data network systems for businesses. It collaborates with numerous third-party data brokers and maintains its own consumer information database. You can opt out of Oracle’s data collection program on their website.

Acxiom, LLC: As one of the largest data brokers, Acxiom collects vast amounts of personal information on hundreds of millions of consumers globally. The company might aggregate data such as political beliefs, health issues, and religious affiliations, selling this information to businesses in sectors like finance or telecommunications. Consumers can opt out of Acxiom’s data collection program.

Equifax Information Services, LLC: Besides being a data broker, Equifax is one of the top three credit reporting agencies in the U.S. It collects consumer financial information that businesses use for targeted marketing campaigns and investors use to assess organizations. To opt out of Equifax’s data collection, you need to unsubscribe from their marketing emails and prescreened credit card offers.

Experian, LLC: Experian is another of the big three credit reporting bureaus in the U.S. Similar to Equifax, Experian provides financial and personal information to businesses and investors. To opt out of Experian’s advertising program, follow the instructions on their website and separately opt out of their credit card offers.

What personal information do data brokers collect?

By utilizing various sources, data brokers can compile extensive information about you to create user categories for businesses to target with marketing efforts. For instance, if you visit websites selling baby products, the broker might categorize you as “new parents.”

Some of the information brokers collect may be sensitive and something you’d prefer to keep private, such as health issues, past bankruptcies, or legal troubles.

There is also the possibility of being incorrectly categorized. For example, if you buy a cookware set as a birthday gift for your mother and browse several cooking sites before making the purchase, a broker might label you as a “cooking enthusiast” even though the gift was not for yourself.

Here are some personal details that a broker can collect to create a consumer profile:

- Full name

- Gender

- Birthdate

- Contact information (e.g., phone number and email)

- Home address and previous residences

- Marital status and family situation, including children

- Social Security number (SSN)

- Level of education

- Assets

- Job

- Purchase habits

- Interests and hobbies

- Criminal record

- Political preferences

- Health history

How data brokers use your information

Businesses are constantly seeking valuable consumer information. Purchasing data from brokers enables them to tailor marketing campaigns to demographics most likely to buy their products.

For example, if you’re a fan of virtual reality (VR) gaming, frequently watching YouTube videos about it and searching Amazon for VR headsets, you would be an ideal consumer for a company manufacturing VR headsets or creating VR games.

Additionally, other companies might use your data for risk mitigation. For instance, a bank might use your financial history to assess the likelihood of you defaulting on a mortgage loan.

How to protect your data from data brokers

Various public records and sources are available for data brokers to gather information about you. The encouraging news is that there are steps you can take to limit the amount of personal information they can access:

- Be discerning about what you share online. Avoid oversharing personal information on social media platforms and refrain from participating in online quizzes and sweepstakes.

- Utilize a virtual private network (VPN) whenever possible. A VPN conceals your IP address and encrypts your data as you browse the web. Products like McAfee’s Secure VPN safeguard your personal data and credit card information, allowing you to browse, bank, and shop online securely without concerns about prying eyes such as data brokers.

- Employ a Tor browser, such as the ones offered by the Tor Project or The Invisible Internet Project (I2P), to mask your online activities. Tor browser users can maintain anonymity online, although it may result in some reduction in connection speed.

FAQ’s

Where do data brokers obtain my information?

Data brokers gather information from various sources, including publicly available records, online activities such as browsing history and online agreements, and purchase history.

Are data brokers operating legally?

Generally, data brokers operate legally, but regulations vary by region. Some countries have stringent laws protecting consumer data, such as the GDPR in the European Union, while others, like the United States, rely on state-level regulations.

Who are the largest data brokerage companies?

Major data brokerage companies include Epsilon Data Management, LLC, Oracle America, Inc. (Oracle Cloud Data), Acxiom, LLC, Equifax Information Services, LLC, and Experian, LLC.

What type of personal information do data brokers collect?

Data brokers collect a wide range of personal information, including full name, contact information, demographics, purchase habits, interests, criminal record, political preferences, and health history.

How do data brokers use my information?

Data brokers sell aggregated consumer data to businesses for targeted marketing campaigns. They also provide information for risk assessment purposes, such as determining creditworthiness.

How can I protect my data from data brokers?

To limit the amount of personal information accessible to data brokers, individuals can be selective about sharing information online, use virtual private networks (VPNs) to encrypt their internet connection, and utilize Tor browsers to maintain anonymity online.

Can I opt out of data broker information collection?

Some data brokerage companies provide opt-out options on their websites for individuals who wish to restrict the collection and use of their personal information.

Conclusion

Data brokers are pivotal in the digital age, collecting and selling personal information to businesses worldwide. While operating legally, regulations vary, necessitating consumer vigilance. Major players like Epsilon, Oracle, Acxiom, Equifax, and Experian dominate the industry. However, individuals can take steps to protect their privacy by being cautious online and utilizing privacy tools. Understanding data collection methods empowers individuals to safeguard their privacy in today’s data-centric world.

ad

Comments are closed.