How To Setup A PayPal Business Account?

Learn how to create a PayPal business account work for your small business, from setting up your account to figuring out fees.

PayPal is a common way for people to get paid for selling goods or services. It’s easy to use, safe, and there are no fees to set it up. Even though you can still send and receive money with a personal PayPal account, using a business account has some extra benefits.

There are a lot of ways to integrate payments and eCommerce, such as by taking credit card payments or using apps for mobile payments. PayPal also has great customer service and a place to solve problems. This lets you quickly fix any problems at checkout or talk about other ways to process payments.

You can also handle transactions with other countries, block payments, and make billing information. Business PayPal accounts have more features and ways to pay than personal PayPal accounts. Here is all the information you need to set up a PayPal business account.

ad

What Is A Business PayPal Account?

A PayPal business account is a PayPal account that lets you accept payments and gives you access to features like online invoicing, a virtual terminal, recurring billing, and more. It’s easy and quick to set up a PayPal business account, and there are no monthly or annual fees.

| Related Article:

ad

What You need to setup a PayPal account for a business

Before you log into PayPal, you should get the following things together to make setting up your business account quick and easy:

- An email address

- A business phone number

- Your legal business name — your own name is fine if your business is a sole proprietorship

- The last four digits of your SSN

- Your Employer Identification Number (EIN) — if you choose individual/sole proprietorship as your business type, you don’t need to provide an EIN

- Your date of birth of the business owner who will create PayPal business account

- Your residential address

- Your bank name, account number, and routing number

Steps to setup your Business PayPal Account

1. Go to PayPal.com and click on Sign Up.

2. Choose Business Account and click Next.

3. Enter your email address. Select an email address that is not tied with a personal PayPal account. If you use an email address that is already connected to a PayPal account, that account will be terminated.

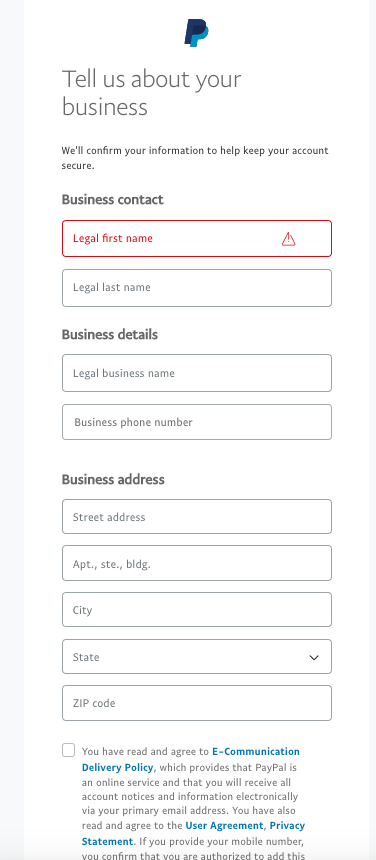

4. Enter some basic information about your business, like the name of the person who owns the account, the name and address of the business, your email address, and the name and number of someone who can help with customer service. Click Agree and Create Account once you’ve given all the information asked for.

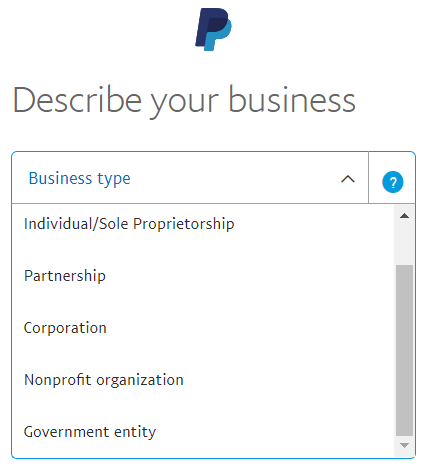

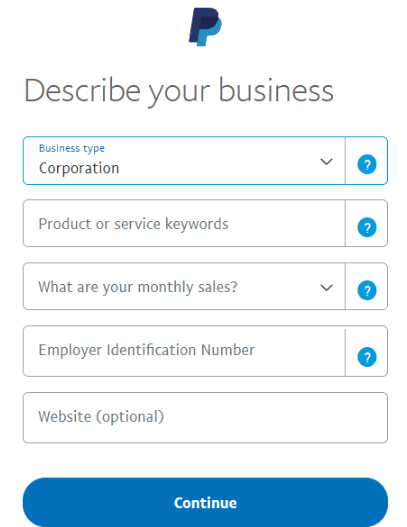

5. Give more information about what your business does. You will be asked to say if your business is a sole proprietorship, a partnership, a corporation, a non-profit, or a government agency. Depending on how you answer, you may be asked about the products or services your business offers, your business identification number, sales, or URL.

6. Provide your personal contact information. You’ll need to provide the last four digits of your social security number, your date of birth, and your home address to open an account. Once you’ve finished this step, click Submit.

| Related Article:

7. Verify your email address. PayPal will send you an email within a few minutes to confirm the email address you’ve provided. Open the email and double-check your email address. This step is required before you can begin using your account.

8. Give the details of your bank account. Log into PayPal and enter your bank account information as directed in the email. If you don’t have a business account, you can use a personal bank account number. To complete this step, you’ll be asked for your bank’s name, account number, and routing number.

When finished, PayPal will send a verification request to your bank by depositing two small amounts into your account. This process takes three to five days, so keep an eye on your bank account for two small deposits from PayPal. When you see the transaction, you can finish setting up your account.

9. Access your PayPal account. Additional instructions for verifying your banking information may be provided. Once completed, PayPal will prompt you to select the payment methods that your company will accept. At this point, you’ll have access to all of the other features of a PayPal business account.

This is enough to get started selling, but once you start accepting payments and making money, PayPal may ask for more proof, like bank statements. Third-party processors like PayPal and Square are known for closely watching merchants, which can lead to holds or account terminations at the slightest sign of trouble. Be ready to give PayPal any information they might ask for.

Read our article on how to avoid having your account held, frozen, or closed to find out more.

| Related Article:

Benefits Having PayPal Account For Your Business

Why should a business get a PayPal account? Let’s look into the reasons why.

- Free: Setting up a PayPal business account doesn’t cost anything, and neither do the monthly or annual fees (unless you opt to use PayPal Payments Advanced or Pro to accept payments).

- Access to features for business: If you have a PayPal business account, you can use features like a virtual terminal, recurring billing, a hosted checkout page, and invoicing. You can also use PayPal Here/Zettle to sell things in person with your phone.

- Sell Online Or In Person: Use PayPal for your business and get paid online or in person. Accept credit and debit cards, PayPal, PayPal Credit, and mobile payment apps.

- Your Employees Can Use Your Account: Sign up for a business account and up to 200 of your employees can use your PayPal account. Each employee can have their own login ID and level of authority.

- Wide Acceptance: If you have a PayPal business account, you can connect it to a lot of different shopping cart software. There are many POS integrations for stores with physical locations.

Types of PayPal Business Accounts

When you set up a PayPal business account, you can choose from three different ways to get paid.

1. PayPal Checkout For Businesses

PayPal Checkout is a good choice if you want to add PayPal as an additional payment option to your website or if you already work with an eCommerce provider. You’ll have PCI compliance (PayPal sends customers to its secure site to finish the transaction), contextual checkout buttons, and payment methods that are localised for customers in Europe.

Signing up for PayPal Checkout is free, and there are no monthly fees.

2. PayPal Payment Advanced

PayPal Payments Advanced is a better way to pay than PayPal Checkout because it has more features. Payments Advanced costs $5 per month and has the same eCommerce integrations as PayPal Checkout. It also lets your customers pay right on your website. This is done with the help of hosted checkout templates. With these templates, the payment information goes through PayPal’s servers instead of your own, so you don’t have to worry about PCI. You’ll also get a good amount of extra features, such as:

- Accept credit and debit cards (your customers don’t need a PayPal account).

- Accept PayPal payments

- Send bills online to get paid quickly.

- You can take payments from 202 countries in 25 different currencies.

- PCI compliance was made easier.

- No setup, withdrawal, or cancellation fees. No long-term contracts.

- PayPal transactions can be made with a discount for non-profits

- Help over the phone for free

- Offer special payment plans for purchases of $99 or more

3. PayPal Payments Pro

To use PayPal Payments Pro, you have to pay $30 per month. It’s for merchants who want full control over the checkout process. It’s also the only PayPal business plan that gives you a virtual terminal, which you can use without Payments Pro but will still cost you $30/month.

With PayPal Payments Pro, you’ll get the following:

- Virtual Terminal

- Accept PayPal payments

- A Payment Gateway

- Accept Visa, Mastercard, and American Express

- PCI compliance easier

- You can take payments from 202 countries in 25 different currencies.

How much does it cost having a PayPal business account?

You do not have to pay anything to open a PayPal business account. A PayPal business account is completely free (unless you sign up for the $5/month PayPal Payments Advanced plan or the $30/month Payments Pro plan). Of course, there is no such thing as free payment processing, and PayPal is no exception. When you make a sale through PayPal, you will be charged payment processing fees. Unfortunately, the new pricing scheme implemented by PayPal on August 2nd, 2021 significantly increases the fees paid by small-ticket merchants and those who rely on small donations/tips.

The following are the transaction fees that US-based merchants will pay:

- 3.49% + $0.49 per PayPal Digital Payments (PayPal Checkout, Pay with Venmo, PayPal Credit, Pay in 4, PayPal Pay with Rewards, and Checkout with Crypto) transaction

- 2.99% + $0.49 per online credit/debit transaction with standard card payments

- 2.59% + $0.49 per online credit/debit transaction with advanced card payments (2.99% + $0.49 per transaction if you have Chargeback Protection)

- 2.89% + $0.49 per transaction if you’re on the Payments Advanced (not the same thing as advanced card payments) or Payments Pro plan

- 1.9% + $0.10 for PayPal/Venmo QR code transactions above $10

- 2.4% + $0.05 for PayPal/Venmo QR code transactions $10 and under

- 1.99% + $0.49 per online transaction for nonprofits (check out PayPal For Nonprofits to learn more)

- 3.09% + $0.49 per Virtual Terminal transaction

- 4.99% + $0.09 per transaction under the MicroPayments plan

Remember that the Virtual Terminal costs $30 per month, whether you get it as a standalone feature or as part of Payments Pro. Overall, PayPal’s fees are comparable to those of other third-party processors, though, as previously stated, Square and Shopify both provide a virtual terminal without a monthly fee.

One recent policy change that has irritated sellers is that when a transaction is refunded, PayPal does not refund the processing fee. That means you’ll lose $3.98 if you refund a $100 online purchase to a customer (in the case of a PayPal Checkout transaction). These costs can quickly add up if you are issuing a large number of refunds. Check out our article on credit card refund fees for more information on refund policies in the payment processing industry.

This article does not cover all PayPal fees. Read our article on PayPal pricing for more information on the costs of card readers, conversion fees, American Express processing fees, and chargeback fees. If you’re a seller outside the United States, check out PayPal’s full list of merchant fees, because the fixed portion of your transaction fees (with a 2.59% + $0.49 transaction fee, the fixed portion is 49 cents) will vary depending on the currency you use.

Differences Between PayPal Business and Personal Account

When deciding between a PayPal business account and a personal account, keep in mind that both account types let you send and request money, make purchases, and even get paid for sales you make, as long as you mark these sales as being for “Goods and services,” which will result in transaction fees (and PayPal will check to make sure you’re not trying to avoid transaction fees by mislabeling transactions).

But if you don’t have a business account, you won’t be able to use a lot of features that make business easier, like creating shipping methods, tracking inventory, giving employees partial access to your account, and signing up for services like PayPal Zettle.

Wrapping Up

Despite some security flaws, PayPal remains a viable option for merchants. PayPal works particularly well as a starter option for new businesses, with simple, transparent pricing and extensive eCommerce integrations, and will scale with your business as it grows. Furthermore, online sellers can always use PayPal as an additional method of accepting payments. This is not true of the majority of PayPal’s competitors.

Comments are closed.