What is Venmo? How it works? Fees, Safety, Limits, and Everything Else

Everything you need to know about the well-known money transfer app Venmo, from the basics to fees, safety, trasnfers and limitations

Even if you’ve never used Venmo yourself, you’ve probably heard of the company, especially in the United States. It can be incredibly convenient, but it’s not quite the same as using a bank account or debit card to make simple financial transactions. What is Venmo and how does it operate, then? Everything you need to know is provided here, including information on fees, transfer caps, safety concerns, and more.

Do you want to use Venmo right away? To download the app from the Apple App Store or Google Play Store, click the buttons below.

What is Venmo?

Venmo also announced a new collaboration with Amazon, which will begin in 2022. In essence, the new agreement enables Amazon customers to use the payment method after PayPal’s breakup with eBay.

Who owns Venmo?

Braintree purchased Venmo in 2012, which PayPal purchased in 2013. PayPal’s ownership of Venmo has led to various new features being added to the platform, although they are competing in the same space in some regards.

How does Venmo work?

Because Venmo is a mobile-only platform, you must download the app from the Google Play Store or Apple App Store in order to use it. To send money, you must first sign up for an account and link a US bank account or credit/debit card. Currently, Venmo does not support bank accounts located outside of the United States.

Basically acting as a middleman, the service transfers funds from your Venmo account to the other person’s account. The money might take a few hours to a few days to show up in the account of the other user. The money will be taken out of your account if there are sufficient funds there. If not, it will transfer the entire sum from your chosen payment method (bank account, debit card, or credit card).

How to send and receive money using Venmo?

Money can be sent or requested in the Venmo app by tapping the pay or request button and then entering the other party’s email address, phone number, or username. If you are the recipient of funds, you have the option of keeping the cash in your balance or transferring it to your linked bank account. There is a fee for using Instant Transfer instead of the traditional slower delivery method. Money can be deposited into your Venmo account via your bank or a debit card.

You can use the app to make payments without having the necessary funds in your Venmo account. If you make a payment that exceeds your current Venmo balance, the funds will be deducted from your linked bank account. If the transfer amount is equal to or less than your balance, the platform funds will be used.

Unless you use a linked credit card, there is no fee for making a payment. You can also transfer money from Venmo to PayPal but it’s not just lightening fast.

Is Venmo free?

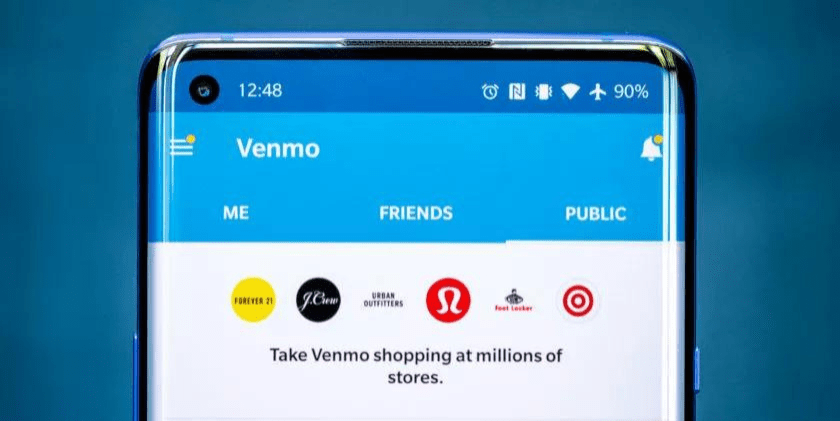

Vendors, who pay a small portion of each transaction that passes through the service, are another source of income for the business. You won’t incur any additional costs as a customer because this is standard procedure. Currently, the app is accepted at more than two million American stores.

If you intend to use Venmo for business, the service will start informing the IRS of any transactions that exceed $600 annually. Instead of creating a new tax, Venmo is just making it simpler to keep track of who owes what. Prior to this change, Venmo would only need to file a report if a user had over 200 business transactions and sent or received more than $20,000 in payments in a calendar year.

Is there a limit on Venmo money transfers?

Yes, there is a weekly cap on the amount you can send to other Venmo users. The cap for brand-new, unverified users is $299.99 per week. The upper limit increases to $4,999.99 per week once you’ve verified your identity by sending in specific identification like your Social Security number, ZIP code, and birthday. The total spending cap is $6,999.99, with an additional $2,000 per week allowed for authorized vendors.

The week begins rolling for Venmo transfer limits at the time of the transaction. This means that regardless of when you made the transfer, every transaction counts toward your limit for exactly one week.

The amount of money you can transfer to a bank account via Venmo is also subject to limits. According to the same guidelines as above, those caps are $999.99 for unverified users and $19,999.99 for verified users each week. However, as a verified user, you can only transfer a maximum of $2,999.99 at once.

Is Venmo safe?

To protect your account, the Venmo app has a few extra security features, like a PIN requirement for each transfer. You can remotely log out of your account on the official website if you misplace your phone or believe someone is using it without your permission.

However, Venmo explicitly states that the service is meant to be used between friends, so you should never send money to an unfamiliar person. If you willingly transfer money to a bad actor, you won’t be able to get it back. Additionally, since anyone can see your comments, be careful what you write in your transfers. The default setting is public to everyone, but you can change it in the settings.

It wasn’t always as safe to use Venmo as it is now. The FTC intervened in 2016 to pressure the business to improve. It was discovered that earlier claims of “bank-level” security were untrue. Scammers could easily defraud users thanks to the Venmo notification system for transfers.

Fortunately, these problems have been resolved today, making the platform safe for everyone to use. Just be aware that it won’t serve as a substitute for a traditional bank account.

FAQ

What Is Venmo Instant Transfer?

Instant transfer is a function that enables users of Venmo to transfer the money in their Venmo account to certain bank accounts or approved Visa and Mastercard debit cards, often within thirty minutes of initiating the transfer. Certain bank accounts are supported for this feature. Each transfer has a fee removed from it that is equal to 1.75 percent of the amount being transferred, with a minimum fee of 0.25 dollars and a maximum fee of $25.

What Is Venmo Direct Deposit?

Direct Deposit is a feature that allows eligible users to electronically deposit all or a portion of their paycheck into their Venmo account. You can avoid the hassle of waiting for and cashing paper checks by setting up Direct Deposit.

Can I Use A Credit Card on Venmo?

Yes, you can use a credit card on Venmo, but it may not be the best idea. Venmo charges a 3% fee for this payment method alone. Furthermore, some card companies may consider this transaction a cash advance, which will result in an additional fee and a higher APR.

What Banks Use Venmo?

Venmo accepts payments from credit, debit, and prepaid network-branded (American Express, Discover, MasterCard, Visa, and so on) cards registered in your name. This means that it should be compatible with any US bank.

It’s worth noting, however, that the creation and popularity of Zelle is what initially prompted banks to develop it. The other payment transfer app, which is backed by 30 major banks, allows you to easily transfer and receive money directly within your normal banking app. Venmo requires you to download the app and is not actually backed by banks.

ad

Comments are closed.